Diversifying Your Revenue Strategy

Cultivating Values-Aligned Financing

A solidarity economy venture isn’t just about making money! It's about making money in ways that uphold community values, strengthen collective ownership, and build long-term resilience! This workbook will help your team:

Part 1. Audit Your Current Income Sources

List everything that brings in money (earned, donated, or granted).

Prompt for your team:

- Where is our money coming from right now?

- How much (%) of our budget does each represent?

- Is it one-time or recurring?

Example Table:

| Income Source | % of Budget | Timing | Alignment |

| Government Grant | 30% | One-time | Medium (depends on funder priorities) |

| Ticket Sales from Events | 40% | Recurring (monthly) | High (mission-driven events) |

| Merchandise Sales | 20% | Recurring (monthly) | Medium (values-branded items) |

| Donations | 10% | Recurring (monthly) | High (community-driven) |

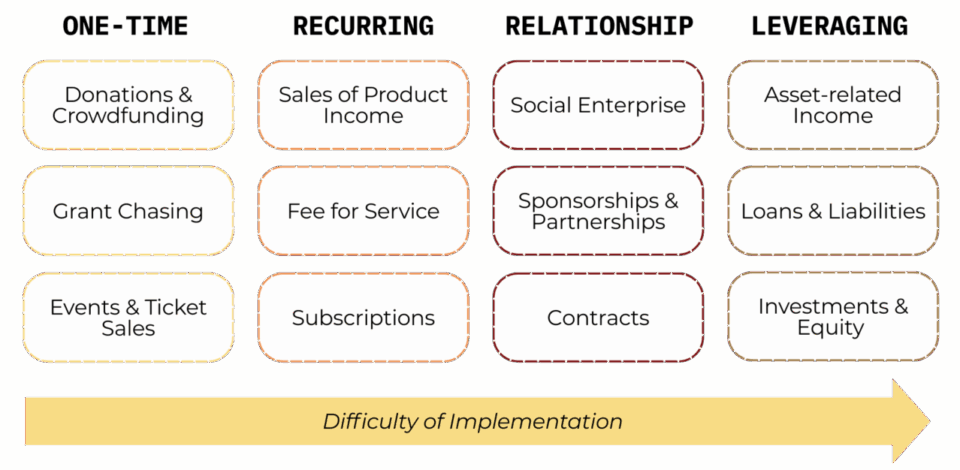

Part 2. Map to Common Income Models & Streams

This is where you check if your mix is truly diversified.

- Model = The design or logic of how you plan to make money.

- Stream = The source where the money actually comes from.

Example:

- Three different grants from different funders:

Multiple streams, but still one model (project-based). - One grant + one set of contracts + member dues:

Three different models, which is more resilient.

Common Pitfall: You may have many income streams, but if they all fall under the same income model, you may still be vulnerable to shocks and external factors!

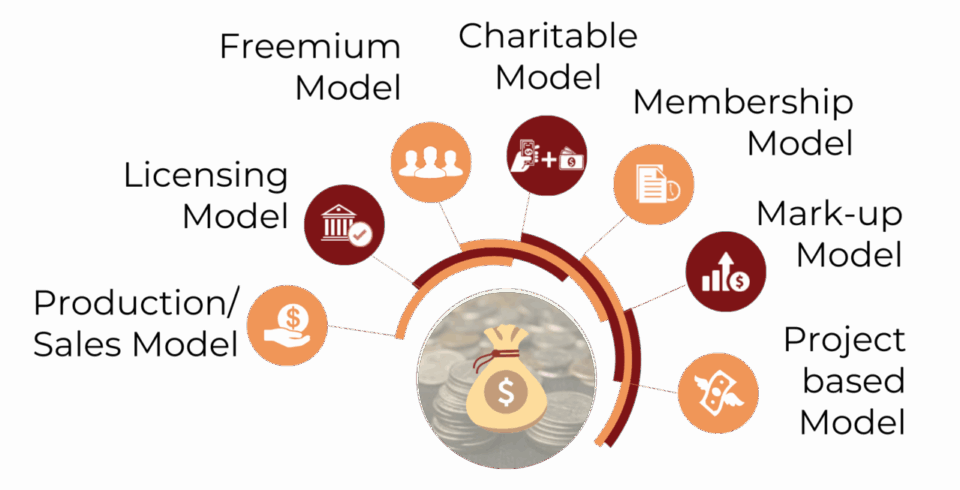

Income Model

The design or logic of how you plan to make money.

See Appendix 1 for the definition of each income model.

Income Stream

The channel where the money actually comes from.

See Appendix 2 for the definition of each income source.

Prompt for your team:

- Which income streams fall under the same model?

- Do we lean too heavily on one model?

- Which models are missing that could add resilience without straying from our mission?

Example Table:

| Stream | Model | Risks |

| Government Grant | Project-based | High dependency risk, competitive, time-bound |

| Ticket Sales from Events | Production / Sales Model | Revenue fluctuates with attendance |

| Merchandise Sales | Mark up Model | Needs upfront investment, inventory risk |

| Donations | Charitable Model | Can be unpredictable, donor fatigue |

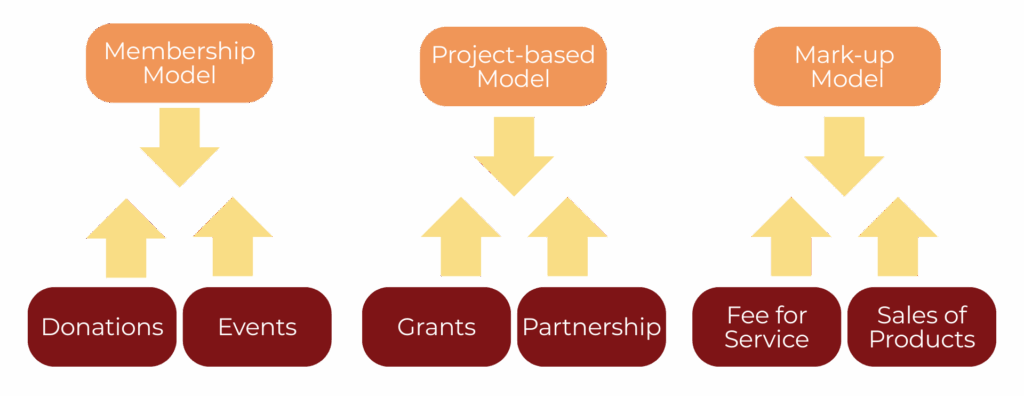

Part 3. Evaluate Your Mix

This diagram outlines that a truly diversified income strategy requires thinking about both:

- Income Models (top layer): the design or logic of how you make money

- Income Streams (bottom layer): the specific sources where money flows in

The arrows demonstrate how we use inductive logic to consider how the models and streams connect together to create your overall income strategy.

The key idea being: An organization may have multiple streams, but if they’re all tied to the same model, it’s not truly diversified.

The takeaway: Diversification isn’t just about adding more sources of money! It's about making sure those sources come from different models. That way, if one model collapses (e.g., grants dry up), others can sustain you!

Part 4. Explore New Models & Streams

Explore some of the common SSE income streams and models defined below in the appendix. Brainstorm ways to strengthen or diversify your income streams without mission drift.

Template for an Income Strategy Statement:

“Our income strategy is to support our mission of [insert mission] by building sustainability through a mix of [main income models]. Currently, our primary sources are [source 1, source 2, etc.], which represent about [X%] of our budget. This creates challenges around [timing, reliability, or over-reliance]. To strengthen resilience, we will diversify by [adding/expanding sources] over the next [timeframe]. This ensures our revenues are both aligned with our values and balanced across different models and timing cycles.”

Example:

“Our income strategy is to sustain our mission of advancing community-driven initiatives through a balanced mix of project-based grants, event ticket sales, merchandise, and community donations. Currently, 70% of our revenues depend on grants and events, which leaves us somewhat dependent on a continuous grant chasing and vulnerable to fluctuations in event revenue.

To strengthen our resilience, over the next 12–18 months we will work to increase recurring community donations and develop additional asset-income related offerings that align with our values, such as rental of AV equipment. This approach will help balance our revenue across different models and timing cycles, reducing dependency risk while reinforcing our values.”

Core Principles of Values-Aligned Financing

- Does this income source align with our mission and values?

- Does it build collective capacity, not dependence?

- Is money available when we need it (timing/reliability)?

- Is it financially viable (enough to cover costs, not extractive)?

Appendix 1. Income Models Definitions

Freemium Model

You offer a basic product or service for free, while charging for premium features, add-ons, or advanced access.

Example: A co-op tool library gives free access to basic community tools, but charges organizations for long-term rentals.

Advertising Model

Revenue comes from selling advertising space or sponsored content, rather than directly charging users.

Example: A community radio co-op runs ads from local businesses to fund its programming.

Charitable Model

Revenue comes from voluntary contributions such as donations, philanthropy, or fundraising campaigns, rather than direct sales or service fees. This model often relies on cultivating relationships with donors and funders who support the organization’s mission.

Example: A solidarity kitchen raises funds through a charitable fiscal sponsor to provide tax receipts for community donations and free meals to low-income residents.

Membership Model

People pay recurring dues (monthly/annual) in exchange for belonging, voting rights, and access to benefits/services.

Example: A capacity building community organization charges a membership fee to access its workshop or rent out its space.

Mark-Up Model

An organization buys goods or services at one price, then resells them at a higher price to generate income.

Example: A bulk-buying food co-op purchases wholesale and sells to members with a small mark-up to cover costs.

Project-Based Model

Funding is tied to specific projects or initiatives, often time-limited. Once the project ends, the funding ends too.

Example: A cooperative art space receives a grant to run a year-long youth program.

Production / Sales Model

Revenue comes from producing and selling goods or services directly.

Example: A worker co-op bakery earns money by selling bread and pastries.

Licensing Model

You generate income by allowing others to use your intellectual property (IP), brand, or product design for a fee.

Example: A software co-op licenses its open-source platform to other organizations under a paid support plan.

Appendix 2: Income Sources Definitions

Donations & Crowdfunding

Voluntary contributions from individuals, communities, or groups. As well as crowdfunding on platforms (like OpenCollective and La Ruche) to pool many small donations for a project or cause.

Grant Chasing

Applying for competitive funding from governments, foundations, organizations or institutions. Please note that grants are often (but not always) restricted to specific activities, timelines, and deliverables.

Events & Ticket Sales

Income from hosting events (performances, conferences, workshops) where participants purchase tickets.

Earned Revenue from Sales

Selling goods or products directly to customers. Revenue comes from market transactions and are often taxable (e.g., food, crafts, clothing, or other products made by the organization).

Fee for Service

Charging customers (either individuals or organizations) for access to services or expertise (e.g., training programs, consulting, educational workshops, or professional services.).

Social Enterprise

Running a mission-driven business arm whose profits support the organization’s social purpose. Distinct from “fee for service” and “earned revenue from sales” because it is set up as a separate yet embedded enterprise with reinvested profits, not just service fees.

Sponsorships & Partnerships

Corporate, organizational or institutional financial support in exchange for visibility, association with the mission, or collaboration. Often involves mutual benefit agreements or a memorandum of understanding between the parties.

Shared Services

Pooling administrative or operational services across multiple groups (e.g., software, wholesale purchasing) and charging fees to participating members or partners.

Contracts

Formal agreements with governments, NGOs, or businesses to deliver a project, program, or service. Typically gained through a competitive request for proposals (RFP) process for larger-scale service offerings and tied to deliverables, outcomes, and accountability.

Asset-related Income

Revenue generated from renting, leasing, or leveraging physical assets (e.g., renting out space, equipment, vehicles, or licensing intellectual property.).

Loans & Liabilities

Borrowed money from banks or social finance institutions that must be repaid (not true “income” but a financing source). Can be leveraged to scale programs or bridge cash flow gaps.

Investments & Equity

Returns from investments (e.g., dividends, interest, capital gains) or by selling equity stakes (where possible). More common in co-ops engaged in raising large scale capital.